The future of Vietnam equity market

Vietnam Stock Exchange will be seeing its largest IPO with the listing of Vietnamese mall operator Vincom Retail JSC. The initial public offering could raise up to US$680mn. The amount is significantly larger than the recent high profile IPO of VietJet- the Vietnamese low cost airlines. Vietjet raised US$167mn in its IPO early in the year. The VietJet’s IPO was Vietnam’s largest until Vincom Retail. Prior to Vincom’s IPO, Vietnam has hosted US$422 million of IPO this year in 2017, according to data compiled by Bloomberg.

The sizeable IPO was possible due to it’s shorter than usual settlement days. The settlement time for Vincom Retail will be five days- significantly faster than the traditional six to eight weeks settlement time in previous Vietnam IPOs. The long settlement time has prevented many foreign institutional investors in subscribing to IPOs in Vietnam. The company has sped up the process by listing first, and then selling the shares. The shorter settlement time has attracted many institutional investors. Based on the latest news, nine cornerstone investors have already subscribed to 59% of the IPO.

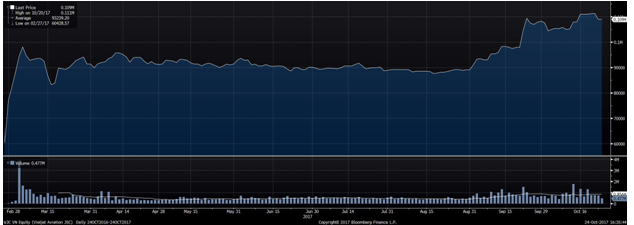

Vietnamese IPOs in the past have struggled to attract foreign demand, due to the long settlement time. The long settlement time forced investor to take unnecessary market risk while waiting for IPO. Vietjet and VPBank’s IPOs this year were successful, but investors have to wait at least two months before they can list. The success of Vietjet’s share price performance post IPO indicates the significant appetite from foreign investors. Vietjet’s share price was up by more than 60% in the first week after IPO. The share price is now trading 80% higher than its IPO price.

Source: Bloomberg

Source: Bloomberg

Vincom Retail is the largest shopping mall operator Vietnam, with 41 shopping malls in Vietnam, and expected to grow to 200 malls by 2021. Like many domestic orientated companies, the company benefits from the fast growing consumption of Vietnamese middle class, and the benign macro environment. The government expects the economy to grow by 6.7% in 2017, and similar rate in 2018.

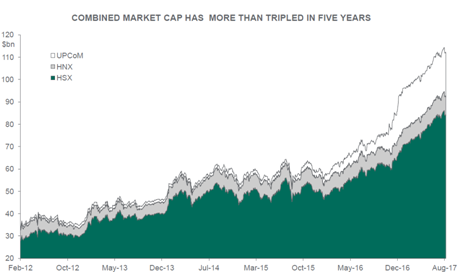

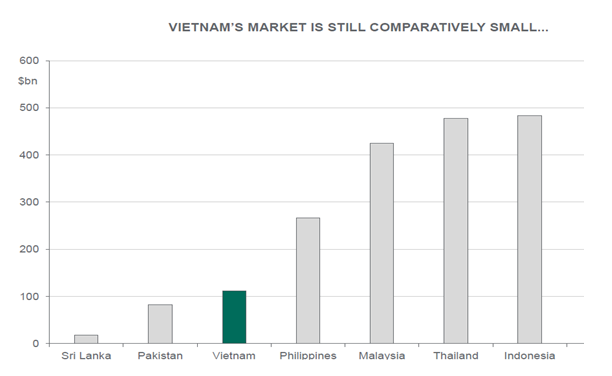

The strong economic growth has also triggered a growth in corporate earnings and a rally in the Vietnam equity market. The benchmark Ho Chin Minh Stock Index is up 23% year to date, the highest since 2008. The combined market cap of the Vietnam equity market has more than tripled in the last five years. The equity market is still relatively small at slightly over US$110 bn, half the size of Philippines equity market.

Source: Bloomberg, Dragon Capital

Hence, there’s significant potential for the Vietnam equity market to be much bigger as its economy grow, and both its private and public sector gain access to the equity market. The precedent set by Vincom IPO could potentially speed up listing of more private and public companies. The government is also addressing the foreign ownership limits in 2018, which will help more foreign inflow to the stock market. Further privatization of SOEs will also broaden the stock market and improve liquidity in the market.

For example, the government through the State Capital Investment Corporation (SCIC) has announced to sell 3.33% of the largest listed company Vinamilk on Nov 11. The 3.3% stake is estimated to be worth US$325m. What’s critical is that the condition given to non-resident foreign investor is a lot more relaxed compare to previous placements. Foreign investors are allowed to suspend share transfer or cancel their bids one day before the share auction, if the share prices in the market fluctuate wildly. Foreign investors can also place deposits in both Vietnamese Dong or US dollars in all banks, unlike previously when investors have to place dollar deposits only in Bank for Foreign Trade of Vietnam.

Source: Dragon Capital

Source: Dragon Capital

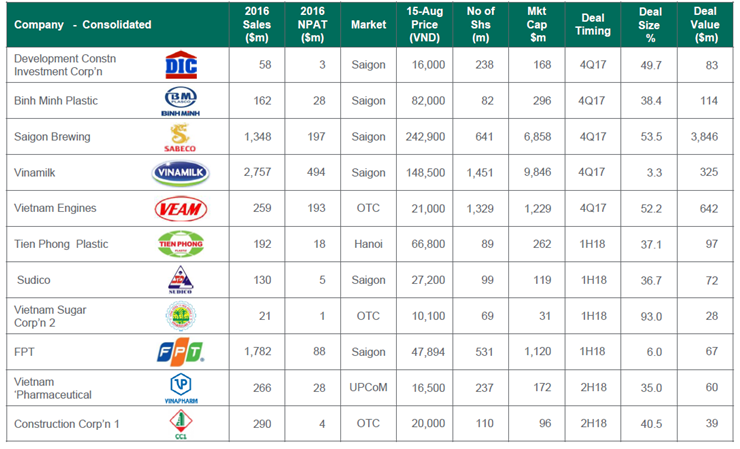

Further liberalization and relaxation in the capital market rules could help accelerate other much delays government divestment and SOE IPOs. SCIC is in the process of divesting government stakes in other SOEs such as Binh Minh Plastics, JSC, Sa Giang Export Corporation, and FPT. Another major divestment is expected in Saigon Brewing (SABECO), a US$7.9bn market cap company. The government own close to 90% of the SABECO and looking to divest further. Dragon Capital also expect at least 11 SOE’s IPOS between now till 2018, with sizeable deals expected for the Binh Son Refining, PV Power and PV Oil in the near term Source: Dragon Capital

Source: Dragon Capital

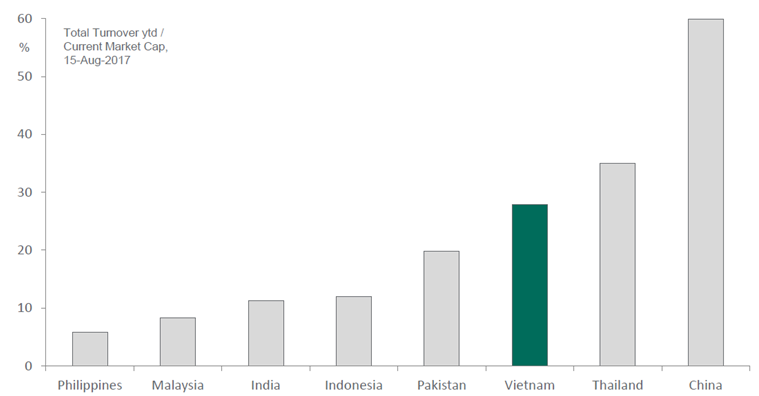

The appeal of Vietnam stock market will continue to grow if the government relaxed the listing rules and the foreign ownership rules in Vietnam stock market. Even at current stage, the Vietnam’s stock market already have higher market turnover/total market cap ratio than some of the emerging markets in Asia like India, and Indonesia. With more SOE listing and divestment, and more private companies listing, the turnover should improve further and attract more foreign inflow. Already, in the first nine months of 2017, the net foreign inflow to Vietnam securities market has grown by 80% YoY to US$1.45bn, according to National Financial Supervision Commission (NFSC). We believe the growth is sustainable as long as the government continues its market reform plan.

Source: Bloomberg, Dragon Capital

Footnotes and Disclaimer

Investment involves risks, including possible loss of principal amount invested. Past performance or any prediction or forecast is not indicative of future results. Investors should read the offering documents for further details, including the risk factors, before investing. Investment returns not denominated in HKD/USD are exposed to exchange rate fluctuations.

Interests in the fund mentioned in the document may not be offered or sold in Hong Kong, by means of an advertisement, invitation or any other document, other than to Authorized Persons or in circumstances that do not constitute an offering to the public. This document is therefore for the use of Authorized Persons only and as such, is not approved under the Securities and Futures Ordinance (“SFO”) or the Companies Ordinance and shall not be distributed to non-Authorized Persons in Hong Kong or to anyone in any other jurisdiction in which such distribution is not authorized. This document has not been reviewed by the Securities and Futures Commission in Hong Kong. For the purposes of this statement, an "Authorized Person" must be a professional investor as defined under the SFO whose ordinary business involves the acquisition, disposal or holding of securities (whether as principal or agent). The distribution of this information may be restricted in certain jurisdictions.

This shall not be construed as the making of any offer or invitation to anyone in any jurisdiction in which such offer is not authorized or unlawful. This is for informational purposes only and does not constitute investment advice or a recommendation or an offer or solicitation, and is not the basis for any contract to deal in any security or instrument, or for Harvest Fund Management Co., Ltd (“HFM”), Harvest Global Investments Limited (“HGI”), or their affiliates to enter into or arrange any type of transaction as a consequence of any information contained here.

Although the information provided by third party was compiled from sources believed to be reliable, no liability for any error or omissions is acceptable by HFM, HGI, their approved distributors, or their affiliates or any of their directors or employees. The information and opinions contained herein is for general reference only and may change without notice, and should not be relied upon for any investment decision. You are advised to consult your financial adviser before making any investment decision.

This document is issued by HGI. This document is the property and copyright of HGI. Further circulation is prohibited without written consent of HGI. All rights reserved.

Copyright © 2017. Harvest Global Investments Limited

/

/

China

China Hong Kong

Hong Kong USA

USA